If you have multiple properties in your portfolio, then you may have the option of using single or multiple properties as security for future property loans. If you use multiple properties, this is also known as ‘cross collateralisation’ or ‘cross securitisation’.

The advantages and disadvantages of using multiple properties as security

Utilising multiple properties as collateral for an investment property loan—such as leveraging the equity from your primary residence along with the investment property—offers distinct advantages and disadvantages.

Advantages

- Increased borrowing power

Leveraging the equity that you have from multiple properties as collateral can increase your potential borrowing capacity. This strategy may enable you to acquire a higher value property that you may not have otherwise been able to attain if securing the loan with just a single property.

- Potential for loan consolidation

Using multiple properties as security can allow you to consolidate your loans into a single loan with a single regular repayment to make managing your loan commitments easier.

- Potential to remove the need for lenders’ mortgage insurance (LMI)

Lender’s typically require LMI if your loan-to-value ratio (LVR) is more than 80%. In other words, if you have less than a 20% deposit. However, by leveraging the equity in two or more properties, you may be able to bypass the need for LMI altogether.

Disadvantages

- Increased risk

In the event of a default on your investment property loan repayments, the lender is more readily able to repossess multiple properties used as collateral. This scenario may not apply when only a single property is utilised as security.

- Potential selling obstacles

When each of your properties serves as collateral for an investment property loan, selling one may be restricted, or refinancing may become necessary should you decide to sell.

The advantages and disadvantages of using a single property as security

Using a single property as security for investment property loans also has its advantages and disadvantages.

Advantages

- Simpler to understand

Setting up an investment property loan with a single property as collateral makes loan setup and ongoing management easier. There will be less paperwork.

- Lower risk

Your lender can only repossess the single property used as security if you default on your investment property loan repayments.

- No selling obstacles

You will not be prevented from selling a single property used as security for an investment property loan. However, the lender may require part or all of the sales proceeds to pay out the loan, or for the loan to be refinanced.

- The option to use different banks for a primary residence loan vs an investment property loan to seek the lowest interest rate on either

Disadvantages

- Reduced borrowing power

Using a single property as security for your investment property loan will reduce your borrowing power if you have equity in multiple properties that you could use instead.

- Potential need for LMI

Using a single property as security for an investment property loan may require you to pay for LMI if the loan-to-value ratio is higher than 80%.

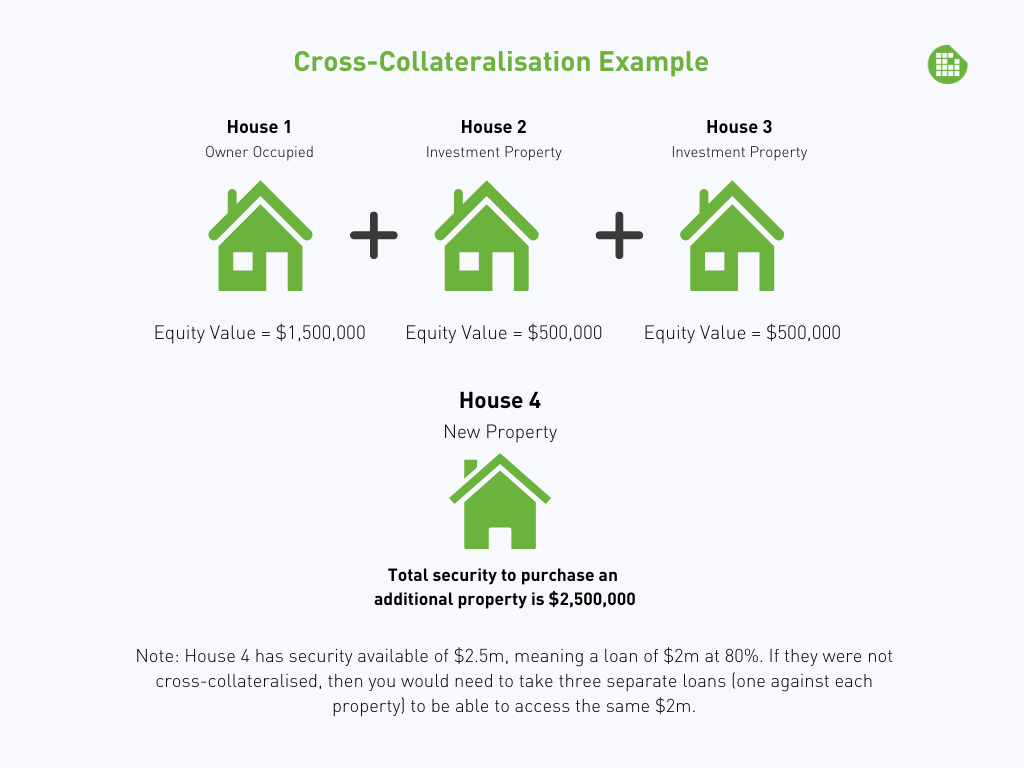

Cross Collateralisation Example

Background:

Tom, a real estate investor in Melbourne, owns three residential properties valued at a total of AUD $2.5 million. He is interested in acquiring a fourth property to expand his portfolio but faces challenges securing additional financing due to his already extended credit.

The Challenge:

Tom needs to secure financing for the new property without selling any of his current assets. He finds managing multiple property loans cumbersome and wants a more efficient way to leverage his existing properties for further investments.

The Process:

- Our lending advisor evaluated Tom’s existing properties, assessing his equity and loan-to-value ratios. He develops a financing strategy that includes cross collateralisation to achieve better loan terms.

- We negotiated with several lenders to find the best terms for a cross-collateralised loan. They focus on minimising interest rates and ensured that the loan terms offer flexibility for future portfolio adjustments.

- We helped Tom consolidate his existing mortgages and the new loan into a single package, simplifying his financial management. This arrangement not only secures the financing needed for the new purchase but also streamlines the overall debt servicing.

The Outcome:

With the help of our lending advisor, Tom successfully secures a cross-collateralised loan that leverages his existing assets while maintaining his investment strategy. This allows him to purchase the fourth property without the need for immediate cash outlays or selling his current investments.

*Please note that names and specific details have been changed to maintain privacy.

The bottom line

Whether you should use a single property or multiple properties as security for your next investment property loan depends on your individual financial situation and investment goals. It is worthwhile to seek independent professional advice to help you make the right financing decision. Please feel free to discuss your options with us.

Wilson Pateras Accounting Pty Ltd is a related entity of Wilson Pateras Lending and Finance (VIC) Pty Ltd and Wilson Pateras Financial Planning Pty Ltd (Wilson Pateras Group). Where you are referred to a related entity by your adviser and take up lending or financial services, your adviser and the directors and shareholders of the Wilson Pateras Group do not receive any direct remuneration or benefit as a result of these referrals but may be entitled to profits as part of their ownership in each entity. You are free to engage your own preferred professional service providers should you prefer

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.