New superannuation laws are coming into effect for the 2024/25 financial year beginning on July 1. The changes are in 3 key areas:

- An increase to the compulsory super guarantee.

- Increases to both the concessional and non-concessional contribution caps.

- Flow-on changes to the ‘bring forward’ rule.

Each change is summarised in turn below.

Increase to the compulsory super guarantee

The compulsory super guarantee that employers must pay on behalf of their staff is increasing from 11% of ordinary time earnings to 11.5% from July 1. Ordinary time earnings are the gross (i.e. pre-tax) amount earned for their ordinary hours of work.

Increases to the concessional contribution caps

The concessional contributions cap will increase from $27,500 to $30,000 per year. Concessional contributions are pre-tax contributions and include:

- Employer contributions made on your behalf (for example, the compulsory super guarantee and any salary sacrifice arrangements).

- Personal contributions claimed as tax deductions.

Concessional contributions are taxed at the concessional superannuation rate of 15% when they are made to your super fund.

Increases to the non-concessional contribution caps

The non-concessional contributions cap will also increase from July 1. It is currently $110,000 per year and it will increase to $120,000, provided your total super balance is less than $1.9 million. Non-concessional contributions are voluntary after-tax contributions to your super that you do not claim as a tax deduction.

Unlike concessional contributions, super funds do not pay 15% tax on non-concessional contributions because it is from after-tax income.

Flow-on changes to the ‘bring forward’ rule

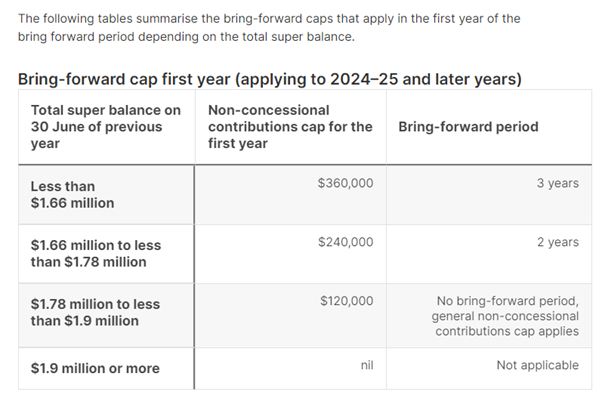

The increase to the non-concessional contribution cap from July 1 will have flow-on effects on the ‘bring forward’ rule. This rule allows you to bring forward your non-concessional contributions cap for up to two years into a current financial year, provided you are under 75 and your total superannuation balance is less than $1.66 million.

After July 1, if you are eligible and your total super balance is less than $1.66 million, the increased non-concessional cap will therefore allow you to contribute up to $360,000 (i.e., $120,000 x 2 brought forward plus the new annual cap of $120,000) into your super in the 2024/25 financial year without exceeding your annual cap. Prior to July 1, you will only be able to contribute up to $330,000 (i.e., $110,000 x 3) without exceeding the current non-concessional contributions cap.

If your total super balance is between $1.66 million and $1.78 million, then after July 1 the increased non-concessional cap will allow you to contribute up to $240,000 (i.e., $120,000 brought forward plus the new annual cap of $120,000) into your super in the 2024/25 financial year without exceeding your annual cap.

If your total superannuation balance exceeds $1.78 million, then you cannot use the bring forward rule. However, after July 1 you can still make up a contribution up to the new annual non-concessional contributions cap (i.e., $120,000) provided your total balance is less than $1.9 million.

Source: Australian Taxation Office

Impacts from 1 July Changes

As a result of the super law changes from 1 July 2024, there will be several other important thresholds that will have the following adjustments:

- Eligibility Thresholds for the Superannuation Government Co-Contribution: Updated thresholds will determine eligibility for government co-contributions to superannuation.

- CGT Contribution Cap: Adjustments to the cap applied following the sale of eligible small business assets.

- Low-Rate Cap: Changes impacting the tax treatment of superannuation withdrawals.

- Redundancy Tax-Free Thresholds: Updates to the thresholds for tax-free redundancy payments.

- Superannuation Guarantee Maximum Contribution Base: Revisions to the maximum contribution base for the Superannuation Guarantee.

These updates are aimed at providing greater flexibility and benefits for superannuation fund members and those managing their retirement savings.

If you would like to discuss any of the above information, please contact Nilay Shah on 03 8419 9800. If you require specific advice in relation to superannuation contributions, we can organise for you to meet with one of our financial advisors.

There is an opportunity now to take advantage of super contributions prior to the EOFY. If you would like more information, please speak to us as soon as possible as contributions must be received by the superannuation fund no later than June 30, 2024.

This content has been prepared by Wilson Pateras to further our commitment to proactive services and advice for our clients, by providing current information and events. Any advice is of a general nature only and does not take into account your personal objectives or financial situation. Before making any decision, you should consider your particular circumstances and whether the information is suitable to your needs including by seeking professional advice. You should also read any relevant disclosure documents. Whilst every effort has been made to verify the accuracy of this information, Wilson Pateras, its officers, employees and agents disclaim all liability, to the extent permissible by law, for any error, inaccuracy in, or omission from, the information contained above including any loss or damage suffered by any person directly or indirectly through relying on this information. Liability limited by a scheme approved under Professional Standards Legislation.