First home savers, downsizers and small business are winners in Treasurer Scott Morrison’s second Budget – while taxpayers face an increase in the Medicare levy.

It’s been a relatively quiet year given last year’s substantial Superannuation changes.

However, there are some measures in the 2017 Federal Budget that could have an effect on many of you.

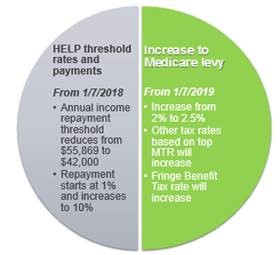

Personal Taxation

Most importantly, there has been no changes to existing personal tax rates and thresholds.

However, there has been a 0.5% increase in the Medicare Levy from 2% to 2.5%.

This is going to affect quite a wide range of people and is going to be quite a substantial revenue raising measure for the government.

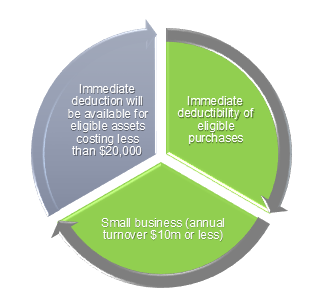

Small Business

There has been an extension of the $20,000 instant tax write-off for each eligible asset purchased by small businesses to the 1st of July 2018. Previously that was due to end on 30th July this year and it’s going to apply to businesses with turnover of less than $10 Million.

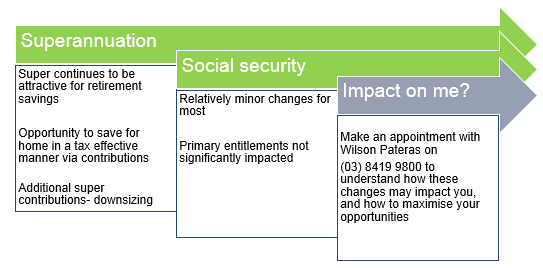

Superannuation

When it comes to Superannuation, First Home Savers will be able to make voluntary contributions of up to $15,000 per annum and $30,000 in total to Super but it can be withdrawn to make a deposit for their first home.

This will apply from the 1st of July 2017 with withdrawals permitted from the 1st July 2018. The taxable component of the withdrawal along with any notional earnings will be taxed at the contributor’s marginal tax rate but less a 30% rebate.

Contributions can either be concessional or non-concessional but concessional contributions will count towards the individual cap of $25,000 per annum.

What’s important about this is there’s no special contributions process that will apply and it will appear that superannuation guarantee contributions can’t be withdrawn for this purpose.

From the 1st July 2018 people aged 65 and over will be able to make a non-concessional contribution, so that’s a post-tax contribution, into their super of up to $300,000 from selling the proceeds of their home.

So, this is aimed at down-sizers and it will apply when the home has been held for more than 10 Years. The amount that is contributed is not going to count against the non-concessional caps and it’s not going to count against the $1.6 Million Dollar limit for non-concessional contributions and the work test doesn’t apply. It does apply per individual. So, it gives a potential exemption of up to $600,000 for retiree couples. Social security exemption will apply to this contribution which is going to reduce its benefit quite substantially for those who have lower assets who are going to be looking to get some form of aged pension eligibility as a result of downsizing their home.

SMSF borrowings

Date of effect: From 1 July 2017 (subject to legislation)

The loan balance of newly established limited recourse borrowing arrangements (LRBAs) will be included in an individual’s ‘total super balance’. The total super balance is used to determine a person’s ability to:

- make non-concessional contributions

- qualify for a Government co-contribution or a spouse contribution tax offset, and

- make catch-up concessional contributions above the annual caps from 1 July 2018, where certain conditions are met.

Also, repayments made from the SMSFs accumulation balance will count towards the member’s transfer balance cap, if the borrowing supports a pension account. The transfer balance cap limits the total lifetime transfers a person can make to retirement phase pensions.

Grandfathering will apply to existing LRBAs, meaning that they are exempt from these new rules. The new rules will only apply to new LRBAs established after the passage of legislation (from the first 1 January, 1 April, 1 July, or 1 December after the passage of legislation).

Housing

In an attempt to increase the supply of affordable housing, a further 10% Capital Gains Tax discount has been announced for investors whose properties are deemed eligible. Affordable housing is defined as that which is provided at below market rents to those who are on low to middle incomes.

Investors in these properties will receive a 60% Capital Gains Tax Discount on the sale of the property rather than the current 50%.

Social Security

For those in receipt of the Aged Pension and other similar entitlements, there will be a one-off energy payment of $75 for singles and $125 for couples paid to those who are eligible on 20th June.

In addition, over 90,000 individuals who lost eligibility for the Aged Pension on the 1st of January this year (so 2017), due to reductions in the asset test, will receive a pension concession card. And this gives them much more generous discounts on medical and health expenses.

Liquid Assets Waiting Period

The maximum Liquid Assets Waiting Period (LAWP) will increase from 13 to 26 weeks. The LAWP is a period that an individual is expected to utilise their own savings prior to receiving Government income support.

The new maximum period will apply to:

- singles without dependents with liquid assets of more than $18,000, or

- couples or single with dependents with liquid assets of more than $36,000.

Liquid assets are readily available assets such as bank accounts, terms deposits, shares and managed funds.

Budget Summary, Impacts and Opportunities

Overall a relatively quiet budget however there are a large number of changes particularly to superannuation that are scheduled to come into effect from the 1st of July following last year’s budget and these may affect you.

If you’d like more information, please phone our office on (03) 8419 9800 or email us.