Here are some helpful visual summaries on the Cash Flow Boost and JobKeeper payment stimulus measures (as part of the Federal Government’s response to the economic impact of the Coronavirus COVID–19 pandemic), prepared by Robyn Jacobson FCA FCPA CTA Tax agent.

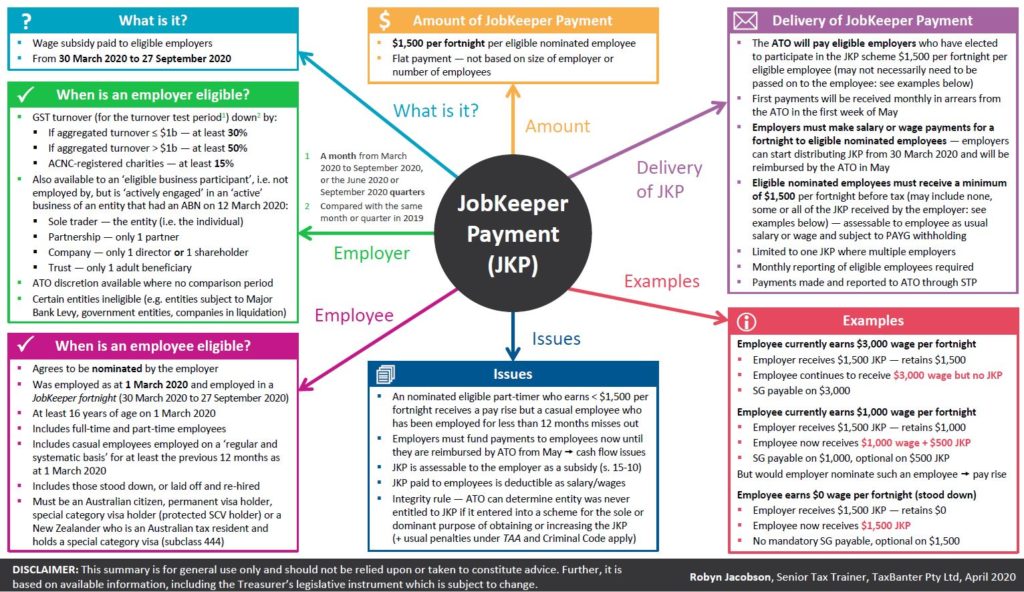

JobKeeper Payment Summary

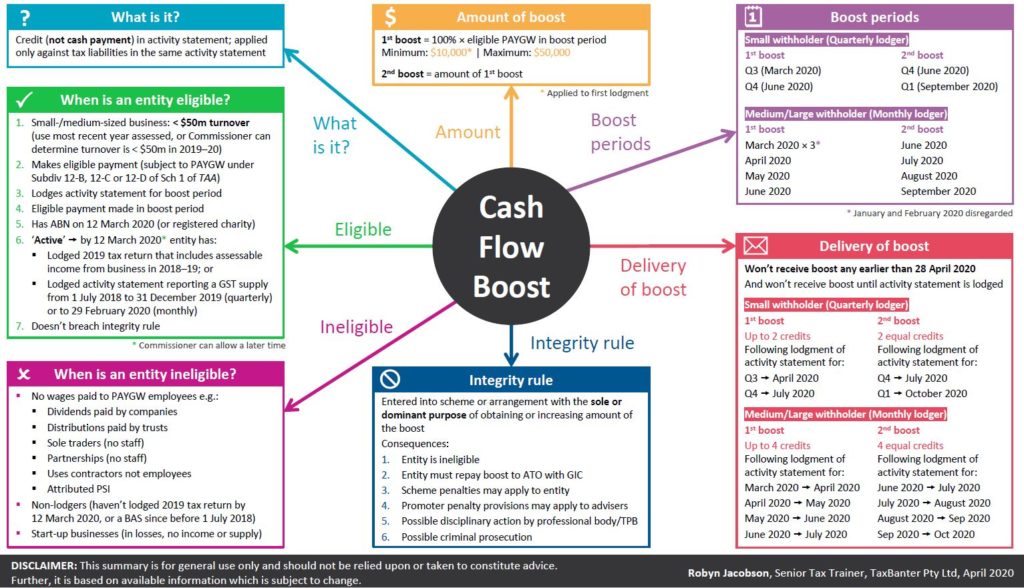

Cash Flow Boost Summary

Who is Robyn Jacobson?

Robyn is well known in tax training circles, having been a professional tax trainer for 23 years and a regular conference presenter. With nearly 30 years’ experience in the profession, Robyn has a public practice background. Her training roles include Webb Martin then as sole director of her own business, Cyntax, before its merger with TaxBanter in 2011. Based in Melbourne, Robyn continues to be a highly regarded tax trainer, providing training through TaxBanter.

Robyn is a Fellow of both Chartered Accountants Australia and New Zealand and CPA Australia, a Chartered Tax Adviser of The Tax Institute and a Registered Tax Agent. She is a member of a number of committees with The Tax Institute and CPA Australia.

Robyn regularly consults with The Treasury, the ATO and the professional bodies on technical issues. Robyn is an avid advocate, social media commentator, blogger, host of TaxBanter’s popular podcast Tax Yak and is regularly quoted in the media. In 2019, Robyn was featured in CPA Australia’s Future Thinkers Series, and was recognised in the Women In Finance Awards 2019 as the Winner of Thought Leader of the Year. She has also recently been named in the global Top 50 Women in Accounting 2019.

These visual summaries are not endorsed by the Government or the ATO. They are for general use only and should not be relied upon or taken to constitute advice. Further, they are based on available information which is subject to change.